How the mortgage guarantee scheme will help buyers with 5% deposits

For anyone who’s found it challenging to save for a 15% or 20% deposit over the past year or so, we’ve got some good news to share.

Chancellor Rishi Sunak announced in the Spring Budget that the government is introducing a mortgage guarantee scheme to help first-time buyers and existing homeowners.

He explained a little about how the scheme will work and what it means for buyers during his speech in the Commons, and in this article we’ll share everything we know so far.

How will the mortgage guarantee scheme work?

Under the new scheme, which will launch in April, first-time buyers and existing homeowners will be able to purchase homes worth up to £600,000 with a deposit of just 5%.

And this means that the majority of buyers should be eligible for the scheme, as our data analysts have found that 86% of properties currently listed for sale on our site have an asking price of £600,000 or less.

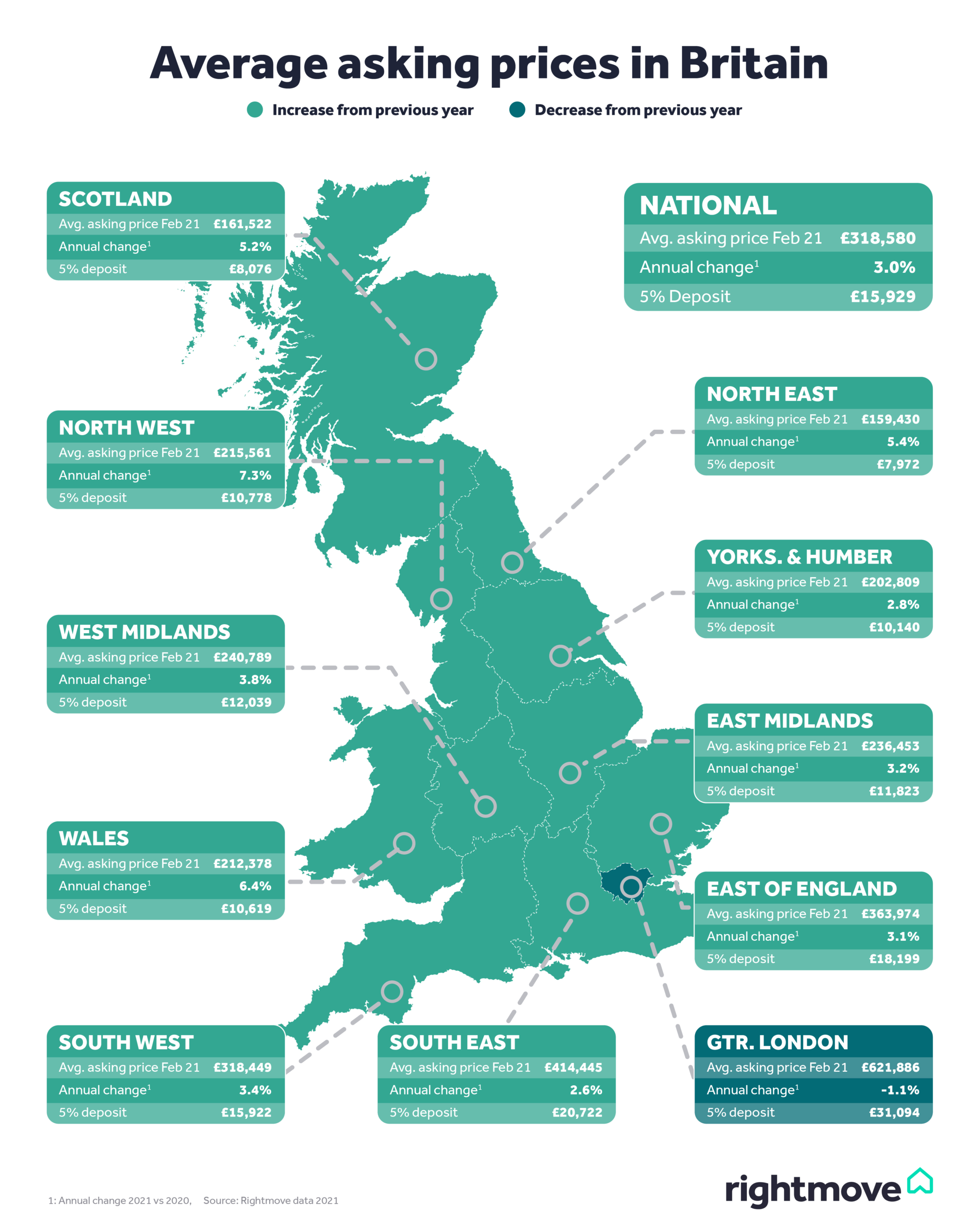

However, please note that with an average asking price of £621,886, many properties across Greater London will be priced above the scheme’s proposed threshold of £600,000 (see below).

The way the scheme works is that the government pledges to repay lenders some of their losses if you as the buyer default on your mortgage repayments for any reason.

In return for this guarantee, lenders have to sell mortgages worth up to 95% of a home’s price – so that you as the borrower can proceed with a deposit of 5%.

It’s a potential game-changer for many first-time buyers as lots of 95% mortgages were made unavailable during the past year.

What impact could the mortgage guarantee scheme have regionally?

What do the experts say?

Our resident property data expert Tim Bannister explained that the new mortgage guarantee scheme will allow many prospective buyers to bring their home-moving plans forward.

He said: “We’ve heard from so many first-time buyers over the past year of their challenges to raise a 15% or 20% deposit, with a substantial number saying they had to put their plans on hold, so the availability of 5% deposits will really help this all-important market sector.

“It could help some buyers bring their plans forward, especially if they managed to save more than they were expecting to while in the various lockdowns. It’s also a helping hand to people who have been struggling to trade up because of the much bigger deposit needed.

“Right now there are not enough properties coming to market to satisfy the increased buyer demand that this scheme will likely bring, so if more people do choose to trade up this could help open up more choice at the start of the property ladder.

“The combination of not enough stock and high demand will help underpin prices, and we’ve calculated that over the past five years asking prices of a typical first-time buyer home has increased by £23,000 on average, so those who can now afford to buy a home will be trying to make the move quickly in case prices rise further.”

What are some of the key statistics?

- The national average asking price for all properties is currently £318,580, which is 3.0% higher than February 2020

- The national average asking price of a first-time buyer property is £200,692, which is 3.6% higher than February 2020

- Since the 2013 Help to Buy mortgage guarantee scheme was first launched, national asking prices have increased by 29% from £246,748 in October 2013 to £318,580 in February 2021

- Since the 2013 Help to Buy mortgage guarantee scheme was first launched, national asking prices for first-time buyer properties have increased by 36% from £147,464 in October 2013 to £200,692 in February 2021

Will the 95% mortgages be for first-time buyers only?

No, the government has confirmed that the mortgage guarantee scheme will be open to all buyers – providing the home you’re buying is worth less than £600,000.

This means that the scheme will help both first-time buyers as well as people who are looking to trade up the property ladder.

How can you apply for a 95% mortgage under the scheme?

Some of the nation’s biggest banks have committed to the scheme, includingSantander, Lloyds, Barclays and HSBC.

Under the new scheme, the usual mortgage affordability checks will still apply.

What this means is that first-time buyers and existing homeowners will need to prove to their lender that they can comfortably afford the monthly repayments after other essential spending has been covered.

To work out how much you might be able to afford, click here to use our Mortgage Calculator.

How does this scheme differ from Help to Buy?

Under the current Help to Buy Equity Loan scheme, which was extended until 2023 for first-time buyers purchasing newly built homes, the government lends you up to 20% of the cost of your newly built home from an approved developer and then shares in any increase (or decrease) of the property’s value.

The property must be your only property and your permanent residence.

You will need to put in a cash deposit of at least 5% and then a mortgage of up to 75% to make up the rest. You won’t be charged loan fees on the 20% loan for the first five years of owning your home. The maximum purchase price the scheme will cover is £600,000.

Comments